Top 10 Reasons Why Real Estate Investment is the Most Profitable

Putting all your investment in a single area may not give you the desired result. Instead, diversifying your investments can help minimize your losses. Many people avoid investing in real estate, thinking it requires lots of money, sometimes it is incorrect!

Is Real Estate a Good Investment?

Real estate investment is an excellent strategy to accumulate capital over time. While it can be a bit more complicated than investing in stocks or mutual funds, there are many reasons why real estate investment is considered one of the most profitable investment strategies available.

In this Blog, we will explore the top 10 reasons why real estate investment is so lucrative.

Appreciation

Real estate is a physical asset with the potential to increase in value over time. In fact, historical data shows that real estate appreciates at a higher rate than the rate of inflation. This means that over time, the value of your property will increase, which can lead to significant profits if you decide to sell.

There are a few factors that contribute to the appreciation of real estate. One is simply the natural increase in demand for housing as populations grow. As more people need homes, the value of existing properties increases. Another factor is improvements made to the property itself. Renovations, upgrades, and maintenance can all add value to a property over time.

Cash Flow

Real estate investment can also provide cash flow in the form of rental income. When you purchase a property and rent it out to tenants, you can generate a steady stream of income each month. Depending on the location and condition of the property, rental income can be quite substantial, especially if you own multiple properties.

The key to generating cash flow from rental properties is to keep expenses low and occupancy rates high. This means keeping the property well-maintained, pricing rent competitively, and screening tenants carefully to ensure they can afford the rent and will take good care of the property. With a solid strategy in place, rental income can provide a reliable source of income for years to come.

Leverage

One of the unique advantages of real estate investment is the ability to use leverage. This means that you can use borrowed money to purchase a property, which allows you to invest in a larger asset than you could with your own funds. This can lead to higher returns on your investment, as you can earn profits on the entire value of the property, even if you only put down a small percentage of the purchase price.

The key to using leverage effectively is to manage risk carefully. While borrowing money can help you grow your portfolio more quickly, it also exposes you to the risk of default if you are unable to repay the loan. Careful planning and analysis can help you determine how much debt is appropriate for your investment strategy.

Tax Benefits

Real estate investment also offers significant tax benefits. For example, you can deduct expenses such as mortgage interest, property taxes, and repairs from your taxable income. Additionally, you can use depreciation to lower your tax liability. Depreciation is a tax deduction that allows you to write off the cost of the property over a set period of time.

These tax benefits can add up quickly, especially if you own multiple properties. They can help to reduce your overall tax liability and increase the profitability of your real estate investments.

Inflation Hedge

Real estate investment is also a great way to hedge against inflation. As the cost of goods and services increases over time, so does the value of real estate. This means that your property will appreciate in value along with the rate of inflation, which can help to protect your investment against the effects of inflation.

Inflation can be a major threat to long-term investment growth. By investing in real estate, you can protect your investment from the effects of inflation and potentially achieve higher returns over time.

Control

Real estate investment provides a high degree of control over your investment. Unlike stocks or mutual funds, where you have little control over the underlying assets, with real estate investment, you can make decisions about how the property is managed, how it is rented out, and how it is maintained. This allows you to maximize your profits and make strategic decisions based on your own investment goals.

Diversification

Investing in real estate also provides diversification benefits to your portfolio. Real estate has a low correlation with other asset classes, such as stocks and bonds, which means that it can help to reduce the overall risk of your portfolio. By adding real estate to your investment mix, you can potentially increase your returns while reducing your risk.

Tangible Asset

Real estate is a tangible asset that you can see and touch. This provides a sense of security that you may not get from other types of investments, such as stocks or mutual funds. With real estate investment, you own a physical asset that has real value and can be sold at any time.

Passive Income

Real estate investment can also provide passive income. This means that you can earn income without having to actively manage your investment. Once you have purchased a property and rented it out to tenants, you can sit back and collect rent each month without having to do anything else. This makes real estate investment an ideal investment strategy for those who want to generate passive income.

Potential for Wealth Creation

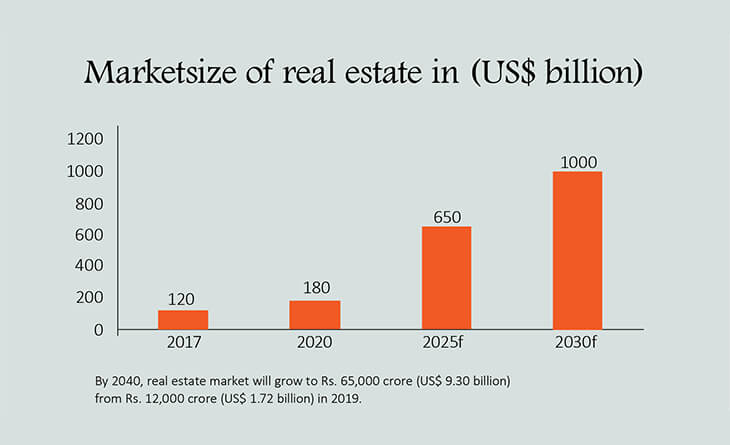

Finally, real estate investment offers the potential for wealth creation. If you make smart investment decisions and hold onto your properties for the long term, you can build significant wealth over time. Real estate investment

Overall, real estate investment can provide numerous benefits to investors, making it one of the most profitable and attractive investments. However, as with any investment, it is important to conduct thorough research and due diligence before making any investment decisions.

No Comments

Sorry, the comment form is closed at this time.